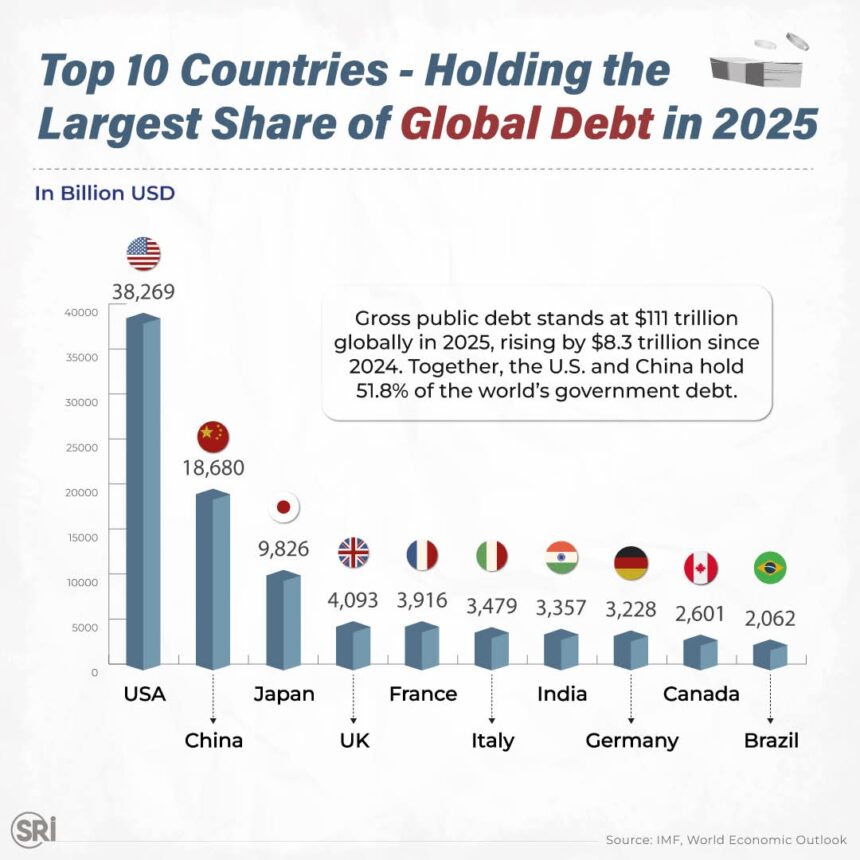

The infographic highlights the countries holding the largest shares of global public debt in 2025 and shows sharp concentrations in sovereign borrowing that matter for markets and policymakers. Global public debt stands at $111 trillion, and the United States and China together account for 51.8% of world government debt, reflecting their outsized economic roles and long-term fiscal commitments.

Among the nations featured are major advanced economies such as Japan, the United Kingdom, France, Italy and Germany, where high debt burdens have been shaped by demographic pressures, sustained social spending and post-pandemic recovery measures. These dynamics underline ongoing fiscal sustainability challenges and the strain on budgetary space in countries with ageing populations and large entitlement programs.

Emerging economies including India and Brazil also appear on the list, underscoring the growing complexity of global public debt distribution as borrowing needs expand beyond traditional economic powerhouses. The concentration of sovereign debt in a handful of countries has implications for global financial stability and the shifting balance of economic power in the international system.

For Pakistani policymakers and investors, the trends in global public debt are a reminder of cross-border spillovers that can affect borrowing costs, capital flows and investor sentiment. Understanding how the largest debt holders influence global rates and liquidity can help shape more resilient domestic fiscal strategies and debt management practices.

Overall, the 2025 debt distribution captured in the infographic offers a useful lens on macroeconomic trends, rising fiscal risks and the need for coordinated policy responses to safeguard long-term sustainability and manage the evolving landscape of sovereign borrowing.