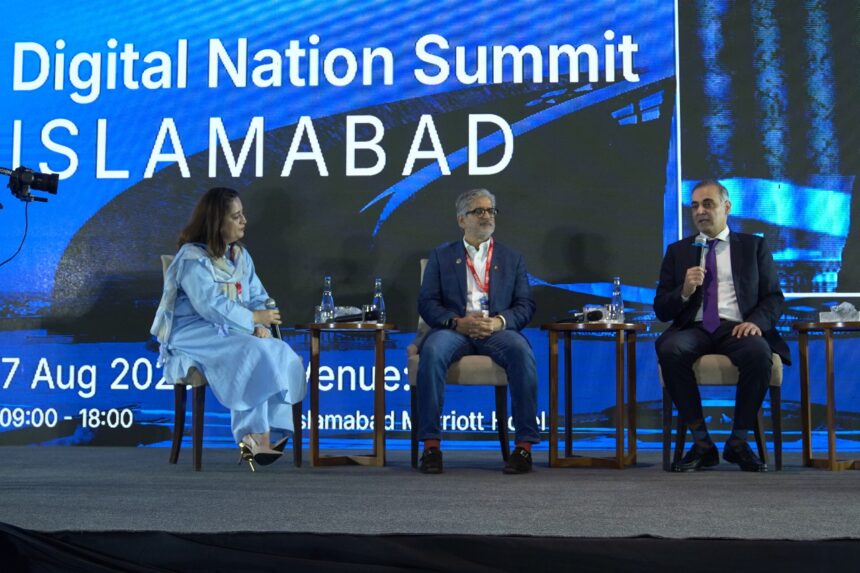

Easypaisa President & CEO Jahanzeb Khan underscored the critical role of customer trust, security, and innovation in advancing digital financial inclusion in Pakistan during the GSMA Digital Nation Summit in Islamabad. Speaking on the significance of these factors, Jahanzeb stressed that building a cashless, digitally inclusive economy requires platforms like easypaisa to balance user convenience with strong security, making safety and trust both visible and reliable for all customers.

During a fireside chat focusing on the evolution from cybersecurity to digital payments, Jahanzeb expressed easypaisa’s commitment to leading Pakistan’s shift toward cashless transactions. He highlighted the company’s efforts to collaborate with stakeholders and policymakers to foster a thriving digital economy. Jahanzeb emphasized that as digital transactions grow, platforms must prioritize user trust by integrating advanced security features and backend safeguards that reinforce customer confidence.

Jahanzeb also advocated for a more interoperable, secure, and inclusive financial ecosystem, echoing the vision of the Government of Pakistan and the State Bank of Pakistan’s Cashless Economy initiative. He called for broad partnerships to ensure every Pakistani can participate in the formal digital economy, ensuring widespread access and engagement.

Highlighting the company’s “Privacy by Design” framework, Jahanzeb explained how easypaisa incorporates data protection principles at all stages of product development. This approach, he noted, is central to delivering secure and scalable financial solutions that make onboarding simpler, expand access for unbanked individuals, and accelerate financial inclusion nationwide.

The GSMA Digital Nation Summit gathered key figures from government, mobile operators, the digital sector, and international partners to promote collaborative efforts towards a secure and inclusive digital future for Pakistan.

Easypaisa currently serves one in every five Pakistani adults, boasts a 31 percent female user base, and recorded over 2.7 billion transactions in the previous year, amounting to PKR 9.5 trillion—approximately 9 percent of Pakistan’s GDP. The company’s achievements continue to set new standards for digital banking and financial empowerment throughout the country.